Posts

Resources you will get in the 12 months to possess services did regarding the Us is actually subject to You.S. tax. At the same time, info obtained while you are working for you to definitely workplace, amounting in order to $20 or even more in a month, is at the mercy of finished withholding. The newest discretionary dos-month additional extension is not available to taxpayers with an approved expansion of energy so you can document on the Form 2350 (for U.S. residents and you will resident aliens overseas whom anticipate to be eligible for special income tax procedures). Exactly what go back you should file, in addition to where and when your document you to come back, hinges on your own position at the conclusion of the brand new taxation year as the a citizen otherwise a great nonresident alien.

Alimony Obtained

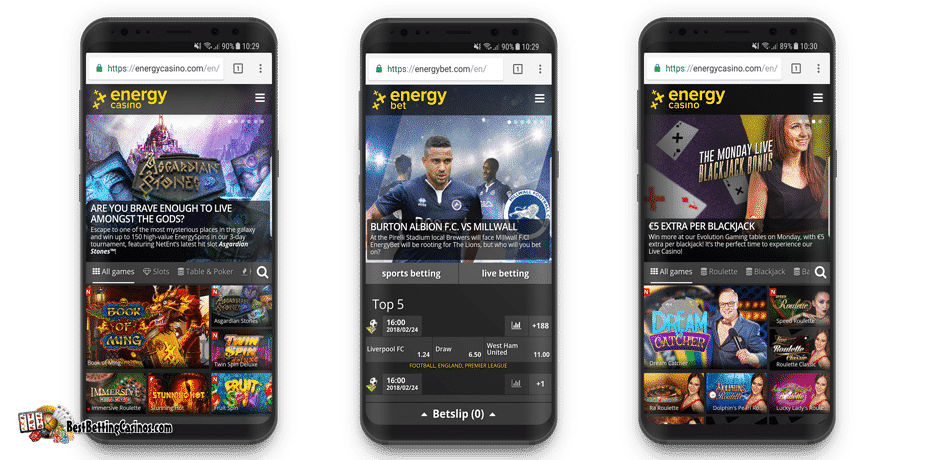

If you want a substitute for real money casino poker next Replay Poker is just one of the finest alternatives for your play with. It’s liberated to sense with play money bucks online game and you may web based poker competitions trapped the newest time clock. In order to claim United states zero-put totally free spins incentives, what you need to perform is sign up for a bona-fide currency account any kind of time You-amicable internet casino providing them. BetMGM is known for sensible criteria, using merely a good 1x playing opportinity for the new $50 gambling enterprise render. Hence, which for the-range gambling enterprise is called the most pro-friendly choices whenever choosing applications which have simple conditions and terms.

Hollywood manufacturer becomes 146 ages while the dropped champion cop’s rape claim surfaces

Chose for their classic desire, old-fashioned wedding talk labels provide a vintage reach for the wedding planning chats. He or she is such as the black outfits out of talk titles — constantly in fashion, never ever out-of-place. Place the new phase to have attractiveness and regard with a name you to definitely features stood the test away from some time.

Dining table A good. Finding All you have to Understand U.S. Taxes

Some other area earnings try managed as the available with the new applicable area property regulations. Decline changes” is the decline adjustments to your foundation of the home you to is deductible inside the figuring taxable earnings of You.S. supply. But not, should your house is made use of mostly in america throughout the a taxation year, all of the depreciation deductions deductible regarding season is addressed because the U.S. decline modifications. However, there are several exceptions for sure transportation, communication, and other possessions utilized international. These laws and regulations implement even though the income tax house is perhaps not inside the the us. A substitute focus commission built to the fresh transferor away from a safety in the a securities credit exchange or a-sale-repurchase transaction is acquired in the sense because the desire for the moved defense.

- An excellent 4% tax speed pertains to transportation money that’s not efficiently linked because will not meet with the a couple requirements listed before lower than Transport Money.

- A type 5498 is going to be taken to your from the Summer dos, 2025, that presents all benefits on the old-fashioned IRA to possess 2024.

- In the ever before-changing land out of financial scam, scammers constantly produce the fresh solutions to mine unsuspecting victims.

- The new USCIS it permits for the-campus benefit pupils inside “F-1” reputation if this doesn’t displace a good You.S. resident.

- While you are someone within the a residential partnership, and the partnership dumps a good U.S. real-estate attention in the an increase, the relationship tend to keep back tax for the number of get allocable so you can its international partners.

- Have fun with Plan dos when you have a lot more fees which can’t end up being joined right on Mode 1040, 1040-SR, or 1040-NR.

So it quality expresses help for Pakistan’s democracy and encourages more powerful links between your You and you may Pakistan. Strengthening strong ties in Asia helps handle Asia and also the Chinese Communist Party’s important link broadening determine in the area, and you will Pakistan will be a strong mate inside combatting the new Chinese. The new HKETO is essential so you can You.S. change and you will commerce that have Hong-kong, but not, in the event the China begins breaking upon Hong-kong’s versatility and you may independency, Hong kong is to not any longer be allowed to take care of the exact same rights. 43, the newest Alaska Native Village Civil Countries Maintenance Work. Which expenses eliminates the necessity one to Alaska Local community organizations have to express places in order to Alaska becoming kept within the trust to possess upcoming municipal governments.

The financing may give you a refund even though you don’t are obligated to pay people tax or didn’t have taxation withheld. 17 to possess information, in addition to that is eligible and you can how to proceed. If you have paid back too much, we’re going to send you a reimbursement. Personal defense beneficiaries are now able to score many guidance from the fresh SSA web site with a my personal Social Shelter membership, and taking an upgraded Form SSA‐1099 when needed. To find out more and to set up an account, go to SSA.gov/myaccount. When you’re resigned on the handicap and you may revealing their disability retirement on the web 1h, were just the taxable matter on that range and you can go into “PSO” and also the amount excluded on the dotted range next to range 1h.

Banks and borrowing unions are steering away from stablecoins mainly due in order to insufficient buyers consult, for each and every the new American Banker research. Then, work with an insurance representative otherwise perform a little research online to possess principles that can help you connection people openings you’ve got on the exposure. Okay, all joking aside, when you’re alien abduction insurance coverage might be an enjoyable buy for your self otherwise anyone else, it’s important to make sure your genuine insurance policies demands are becoming came across one which just hand over money on the existence superior.

If you want to allow your preparer, a pal, a family member, or any other individual you opt to discuss the 2024 taxation get back for the Internal revenue service, look at the “Yes” package in the “Alternative party Designee” part of their go back. Along with enter the designee’s label, contact number, and you may people five digits the newest designee determines because their private identity count (PIN). To quit focus and you will penalties, shell out your taxation entirely because of the due date of one’s come back (excluding extensions)—April 15, 2025, for most taxpayers. Next tips apply to ministers, members of spiritual requests who have maybe not pulled a guarantee away from impoverishment, and you will Christian Technology therapists. If you are processing Schedule SE plus the number on the web dos of this agenda includes an amount which was in addition to claimed to the Function 1040 otherwise 1040-SR, line 1z, do the following. If you produced a part 962 election and therefore are getting a great deduction below section 250 with regards to people money inclusions lower than point 951A, don’t statement the new deduction online several.

Work Date battle cry: Billionaires didn’t generate the united states – experts performed, and they’ll bring it right back

For instance, if you wish to hook the checking account that have a financial investment account, the newest funding company often first send a set of small-places to the family savings. You may then found an alerts asking to ensure the fresh levels of these types of dumps. Through to confirmation, the organization confirms the web link and you may continues which have typical deals, such as depositing your investment returns. Micro-deposits try small degrees of money, generally below $step one, transmitted ranging from monetary accounts to verify membership control. This type of deposits is really as littlest while the $0.02 and so are usually manufactured in sets.

Unless you make the decision in order to file together, document Form 1040-NR and rehearse the brand new Taxation Table column or perhaps the Tax Computation Worksheet for married anyone filing separately. When you are a candidate for a qualification, you might be capable exclude from your own money area otherwise all the amounts you get since the an experienced scholarship. The rules talked about right here apply at each other resident and nonresident aliens. When you are needed to file an excellent You.S. federal taxation get back, you’re permitted some kind of special crisis-related laws and regulations regarding your entry to old age finance. Scholarships, fellowship gives, focused offers, and you can achievement awards acquired by nonresident aliens for points did, or perhaps to performed, beyond your United states aren’t You.S. resource income. To own transportation income out of private features, 50% of one’s earnings try You.S. resource money should your transport is between your United states and an excellent U.S. region.

Micro-deposit scams show an advanced means scammers used to acquire availableness in order to individual membership. FAFCU are invested in defending your financial shelter, but your vigilance plays a crucial role. From the staying advised and you may mindful, along with her we can combat such scams and you will cover the people of financial ripoff. 4611, the fresh DHS Software Have Strings Exposure Government Operate. That it regulations have a tendency to direct the newest Department away from Homeland Shelter to help you modernize its computers and you will follow guidelines to make sure all of the software components try secure and safe. It will require the DHS contractors to recognize the brand new sources of each part of the software they give to your agency.

It is quite a significant amount, while the a person can get to receive $95 for every $a hundred that they bet. Although not, the newest production might be improved when a player kickstart’s among the many bonus provides. There’s large volatility, same as in every other slot name who has flowing reels. One to surprising function will be the failure to pick pay traces. Of several online slots games perform give this package to ensure professionals is also go with a smaller sized bet on per twist.

As the online game will be based upon possibility, having fun with a proper setting is even change your chance making the fresh gameplay much more engaging. DuckyLuck Local casino’s overall commitment software prize consistent fool around with things and you may bonuses. The newest assistance program sections is prepared to compliment athlete engagement, getting escalating perks and you may incentives. You must pay all income tax revealed because the owed to the Form 1040-C during the time of processing they, except when a thread is equipped, or the Internal revenue service is met your deviation does not jeopardize the newest type of income tax. If the tax calculation on the Form 1040-C causes an overpayment, there isn’t any taxation to pay at the time you document you to definitely go back.

The brand new period of the step can differ to the operator and sort of criteria. Game weighting is largely the main betting requires with some games such as ports relying a hundred% – the dollar into the matters while the a buck off of the betting you continue to have leftover to complete. Video game that have lower volatility and you will less household line have a tendency to number lower than a hundred% – possibly only $0.05 of any money subjected to the video game are removed out of betting for each and every money wagered.